Launch your securities career with confidence using "SIE Exam Prep: The Ultimate Study Guide for Securities Industry Professionals." With SIE pass rates declining, this book offers more than just rote memorization; it provides a strategic approach to conquering the exam. Author Riley Moore delivers a 5-step process for analyzing questions, covering regulations, products, and markets in detail. Beyond the in-depth content, including 299+ practice questions, you'll receive bonus materials: a cheat sheet, a customizable study planner, and real-world case studies. This comprehensive guide equips you not only with the knowledge needed to pass, but also with the crucial test-taking strategies for success. Don't just study—master the SIE.

Review SIE Exam Prep

This book, "SIE Exam Prep: The Ultimate Study Guide for Securities Industry Professionals," is a bit of a mixed bag, and my feelings about it are nuanced. Initially, I was drawn to its promise: a comprehensive guide to conquering the notoriously challenging SIE exam. The description certainly hit the right notes – the anxiety surrounding the exam, the desire for a strategic approach rather than rote memorization, and the allure of a structured, step-by-step plan were all very appealing. Many reviewers echoed this initial positive impression, highlighting the book's thoroughness, ease of understanding, and the helpfulness of the practice questions. Several mentioned it was instrumental in helping them pass the exam, and that's a powerful endorsement. The emphasis on a methodical approach to tackling questions, rather than just memorization, is a significant advantage, as the SIE exam requires more than just recalling facts.

However, the reviews also revealed a significant counterpoint, one that I found quite concerning. Some readers felt the book lacked depth, offering a bare outline rather than in-depth explanations. The claim that the practice questions covered topics not adequately addressed in the main text is a serious issue, effectively rendering those questions less valuable. This directly contradicts the book's marketing of "in-depth coverage" and calls into question the overall quality of the content. One particularly critical review compared it unfavorably to the "Dummies" series, which suggests a lack of detailed explanations and clarity.

This divergence in reviews leaves me somewhat ambivalent. While the positive feedback regarding the book's structure, ease of use, and helpfulness for some test-takers is significant, the criticisms regarding the depth of coverage and accuracy of practice questions are equally important. It seems this book might work well for someone who already possesses a foundational understanding of securities and markets and needs a structured approach to test-taking and review, essentially using it to solidify existing knowledge and build exam-taking skills. However, for someone starting with little to no prior knowledge, it might prove insufficient.

Ultimately, I feel that prospective buyers should approach this book with caution. The positive reviews are encouraging, but the negative ones point to serious potential drawbacks. A thorough review of sample chapters or the table of contents would be advisable to assess whether the level of detail and the coverage of specific topics meet your individual learning needs. Considering supplementary resources might also be wise to ensure complete comprehension of all exam topics. In short, while this guide might be a helpful supplement for some, it shouldn't be considered a standalone, definitive solution for mastering the SIE exam without careful consideration.

Information

- Dimensions: 8.5 x 0.62 x 11 inches

- Language: English

- Print length: 275

- Publication date: 2024

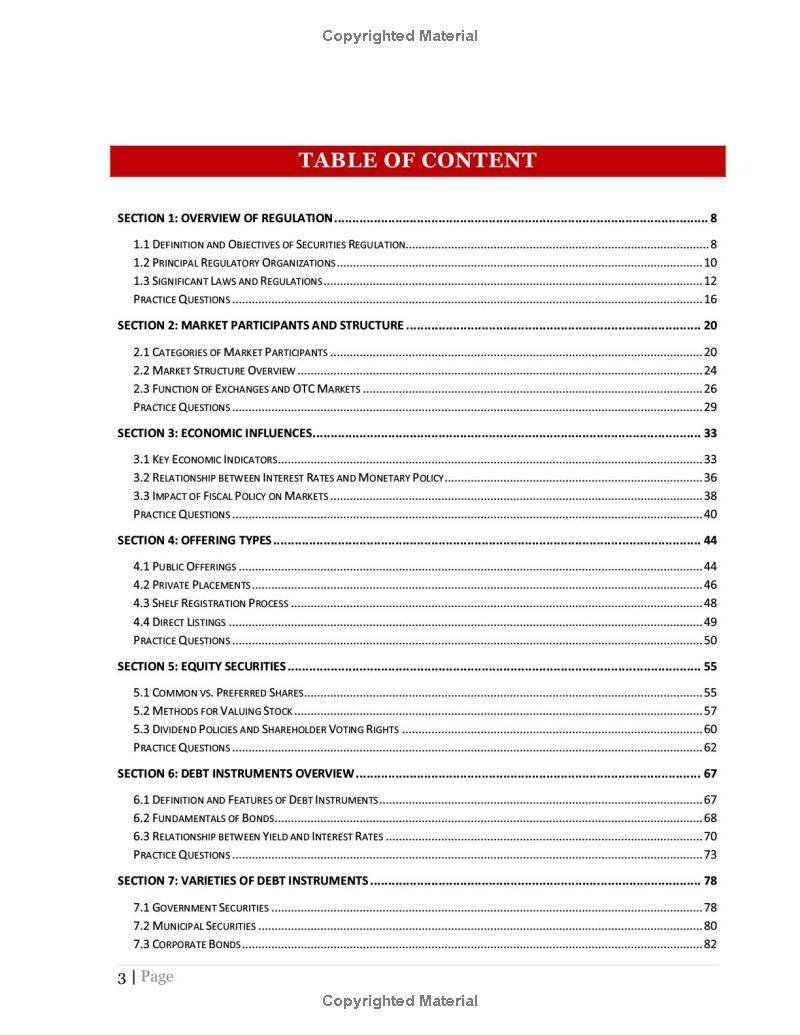

Book table of contents

- SECTION 1: OVERVIEW OF REGULATION

- SECTION 2: MARKET PARTICIPANTS AND STRUCTURE

- SECTION 3: ECONOMIC INFLUENCES

- SECTION 4: OFFERING TYPES

- SECTION 5; EQUITY SECURITIES

- SECTION 6: DEBT INSTRUMENTS OVERVIEW

- SECTION 7: VARIETIES OF DEBT INSTRUMENTS

- SECTION 8: PACKAGED INVESTMENT PRODUCTS

- SECTION 9: VARIABLE CONTRACTS AND MUNICIPAL FUND SECURITIES

- SECTION 10: ALTERNATIVE INVESTMENTS

- SECTION 11: OPTIONS BASICS

- SECTION 12: CALCULATING INVESTMENT RETURNS

- SECTION 13: ORDER TYPES AND TRADING STRATEGIES

- SECTION 14: SETTLEMENT PROCESSES AND CORPORATE ACTIONS

Preview Book